Appreciation And Depreciation Business Definition

Depreciation is an example of the matching principle. What Do Appreciation and Depreciation Mean in Business.

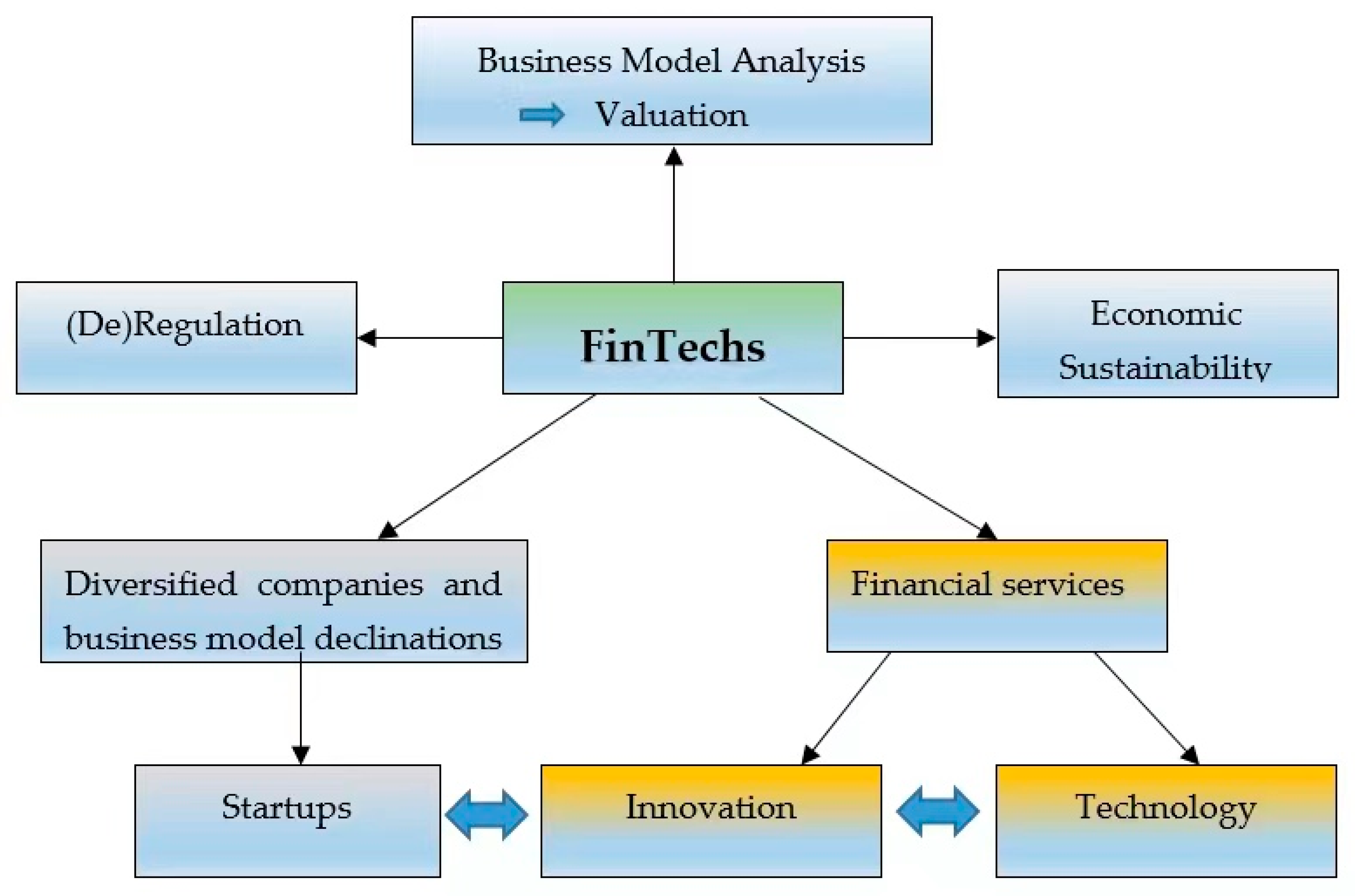

Sustainability Free Full Text Sustainability In Fintechs An Explanation Through Business Model Scalability And Market Valuation Html

Depreciation is an ongoing process until the end of the life of assets.

/dotdash_Final_Currency_Appreciation_Definition_Apr_2020-01-063bf4cdbc9e4f4d82fa4aa46738498d.jpg)

Appreciation and depreciation business definition. Appreciation and depreciation are common discussion points when making a large purchase or investment so theyre useful to understand across many industries. The major difference between appreciation and depreciation is that appreciation refers to an increase in the useful life of an asset while depreciation refers to. Depreciation is therefore a calculated expense which leads to a decrease in earnings.

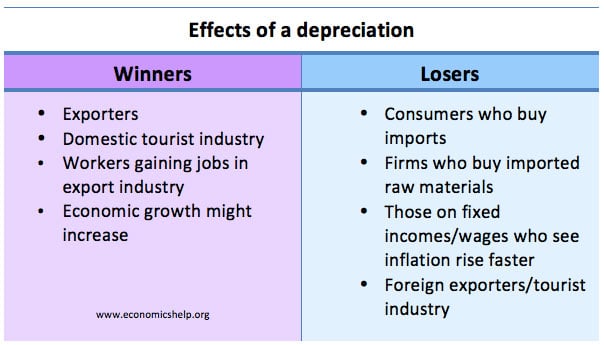

Depreciation on the other hand is the opposite- it is the decrease of value of something over time. Appreciation is an increase in the value of a currency while depreciation or devaluation is a fall in value. Depreciation is the method that the company use for spreading the cost of an asset over its useful life.

Depreciation is when the value of assets goes down and appreciation is when the value of assets goes up. Machinery equipment currency are some examples of assets that are likely to depreciate over a specific period of time. Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life and is used to account for declines in value over time.

Appreciation is the direct opposite of depreciation. Its the opposite of depreciation which reduces the value of an asset over its useful life. Physical wear and tear linked with time or technological obsolescence.

Before you read further heres a quick refresher on what an accounting transaction is. The value of a car is usually decreases in value with time. Most assets can either appreciate or depreciate.

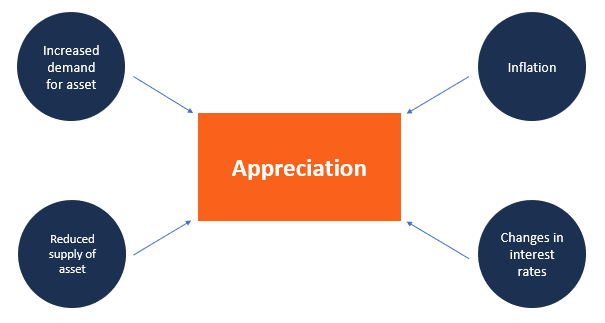

The cost is spread over several years because an asset loses fair value in the market over time. Appreciation is when the value of an asset increases and depreciation is when the value of an asset decreases. Recognition and appreciation.

Depreciation is used to spread a loss in value over each accounting period. What appreciation and depreciation are how to calculate and solve problems involving appreciation or depreciation Appreciation is the increase of the value of something over time. Therefore its value is said to depreciate.

In the absence of such government interventions the exchange rate or the relative price of two currencies is determined mainly. A decrease in the value of an asset over time. In this lesson we will cover.

This is an accounting term used to describe a certain type of write-off. We often use these words interchangeably and think of them as the same thing. The term normally refers to a decrease in asset value.

Depreciation and appreciation are two sides of the same coin. And by using it you will be able to anticipate the purchase of a new asset when the. A decrease in an assets value may be caused by a number of other factors as well such as unfavorable market conditions etc.

In general business usage the term depreciate is more or less the opposite of appreciate. In general depreciation is the expensing of a physical asset such as a truck or a machine over its estimated useful life. For tangible assets the term is used depreciation for intangibles it is called amortization.

Depreciation is a decrease in the book value of fixed assets. But in the world of accounting appreciation and depreciation mean something a little different. Depreciation refers to when the value of something goes down over time.

For example accountants use appreciation to find the positive adjustment of the initial value of an asset and real estate agents use depreciation to find the decrease in a propertys value due to deterioration. Another type of depreciation that can confuse people is asset depreciation. Why is depreciation important in accounting.

Depreciation is the process of deducting the cost of a business asset over a long period of time rather than over the course of one year. Depreciation Methods The most common types of depreciation methods include straight-line double declining balance units of production and sum of years digits. Both processes affect domestic inflation which is the continuous rise in the price.

The idea is to record the expense in the. For example a brand. Depreciation involves loss of value of assets due to the passage of time and obsolescence.

Like appreciate the term depreciate has a broader meaning in general business usage but a more limited and specific meaning in accounting. There are many examples of appreciation and depreciation in real life. Appreciation is when the value of an item increases and depreciation is when an item decreases in value.

Depreciation can be related to. Jack and Trisha. A country may unilaterally peg its currency for various reasons.

Appreciation is the rise in the value of an asset such as currency or real estate. When you use the term appreciation or depreciation make sure youre referring to currencies that are traded in foreign exchange markets with no government interventions. Depreciation is an accounting method used to spread the cost of an asset across its expected useful life.

Accountants have to follow GAAP of course but GAAP allows plenty of flexibility. Opposite of depreciation is appreciation which is increase in the value of an asset over a period of time. But while theyre both important theres a big difference between them.

Explore the definition and principles of this type of management check how management by exception is implemented in business through an example and discover its pros and cons.

Definition Of Collateral Home Loans The Borrowers Business Loans

Business Investing Finance Financeandfreedom Instagram Photos And Videos Finance Investing Finance Real Estate Investing

Appreciation Definition Examples Types Of Appreciation

Foreign Exchange Ba 282 Macroeconomics Class Notes

Network Monitoring Gfi Network Server Monitor Http Coin Nef2 Com Network Monitoring Gfi Network Ser Network Monitor Network Performance Change Management

Indirect Quote Meaning Formula Example And More In 2021 Indirect Quotes Accounting Principles Financial Management

/dotdash_Final_Currency_Appreciation_Definition_Apr_2020-01-063bf4cdbc9e4f4d82fa4aa46738498d.jpg)

Currency Appreciation Definition

Buy And Hold Investment Strategy That Seeks Stable Profitable Companies To Invest In The Long Term Investing Hold On Strategies

Accounting Relationship Linking The Income Statement And Balance Sheet Money Instructor Accounting And Finance Profit And Loss Statement Good Essay

What Is Depreciation Definition And Examples Market Business News

The Top 5 Companies On The Hang Seng Are 1 Tencent 2 Icbc Industrial And Commercial Bank Of China 3 Company Definition Investment Companies Commercial Bank

How To Group Emails From The Same Sender Together In Gmail How To Use Quickbooks Things To Sell Business

Effect Of The Exchange Rate On Business Economics Help

10 Monthly Budget Templates That Ll Make Budgeting Simple Finally Budget Spreadsheet Excel Budget Template Excel Budget Spreadsheet

Posting Komentar untuk "Appreciation And Depreciation Business Definition"