E Stock Appreciation Rights

For stock appreciation rights issued in 2009 the issue price of EuR 1748 constitutes the initial price. Time in the future for a price already fixed in the pres ent Stock-appreciation rights are cashsettled forms of share-based compensation and should.

Stock Appreciation Rights Overeenkomst Voorbeeld Download Direct

A stock appreciation right SAR entitles an employee to the appreciation in value of a specified number of shares of employer stock over an exercise price or.

E stock appreciation rights. The cycle of Stock Appreciation rights covers Granting of option by the company followed by Vesting of the option to the employee. Stock appreciation rights offer the right to the cash equivalent of a stocks price gains over a predetermined time interval. Stock appreciation rights SARs provide the right to the increase in the value of a designated number of shares paid in cash or shares.

Employee stock purchase plans ESPPs provide employees the right to purchase company shares usually at a discount. Employee Stock Option Plan. Indexed options A plan in which a production standard is set for a specific work group and for which its members are paid incentives if the group exceeds the production standard is known as an _______.

Stock appreciation rights E. The term of each tranche of stock appreciation rights is approximately two and a half years the vesting period of each tranche approximately one year. Plain vanilla stock options seem to be the most popular but cases of share purchase plans and stock appreciation rights especially in cross border options schemes are not an uncommon phenomena.

In response to the growing need of using ESOSs as a. Employees are taxed on exercise price without any cash receipt. How Does a Stock Appreciation Right Work.

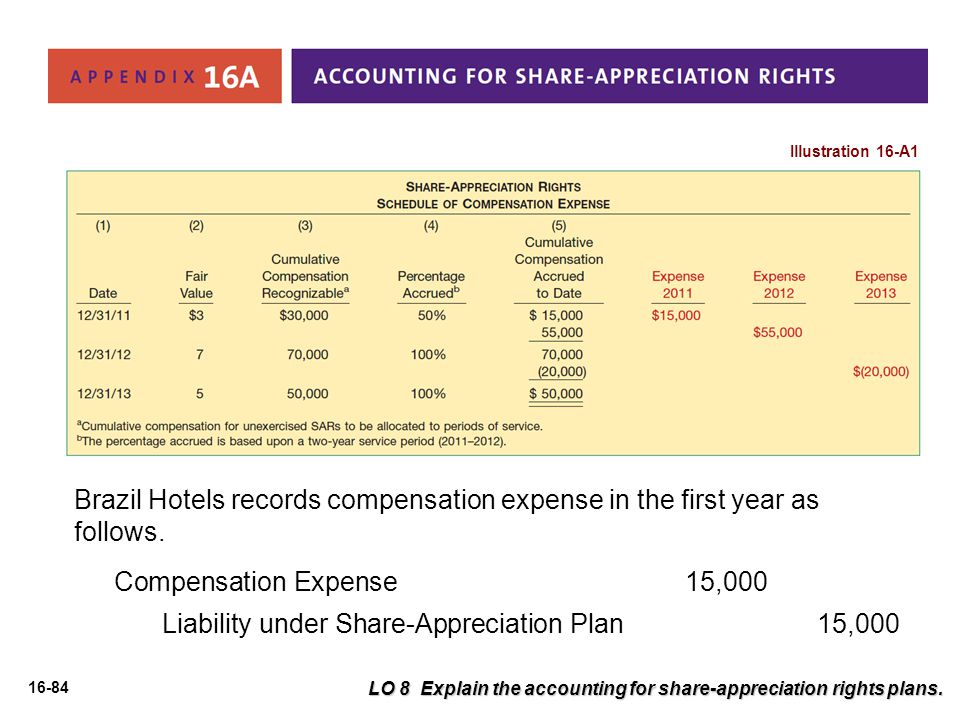

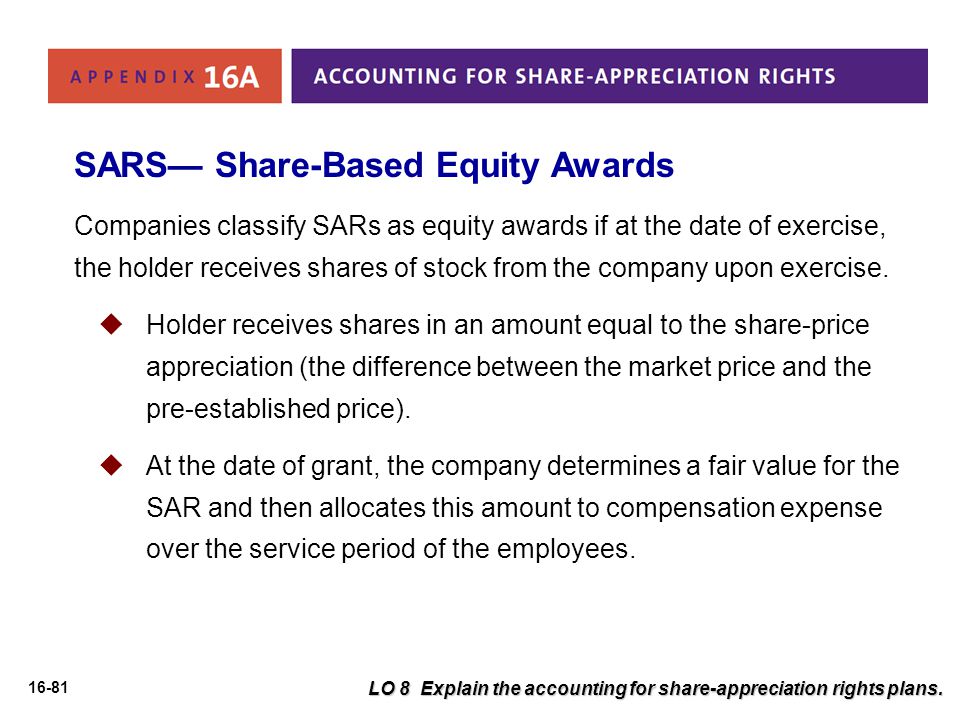

Stock Appreciation Rights Plans. Accounting for stock appreciation rights SARS as share based liability the company gives executives the right to rceive compensation equal to share apprec. Stock appreciation rights represent a form of company profit-sharing where an employee becomes entitled to a future cash payment based on the increase in the companys share price from a specified level over a specified period of time.

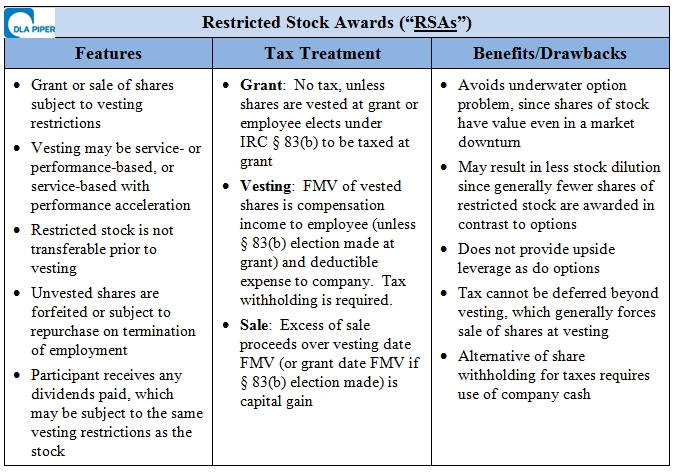

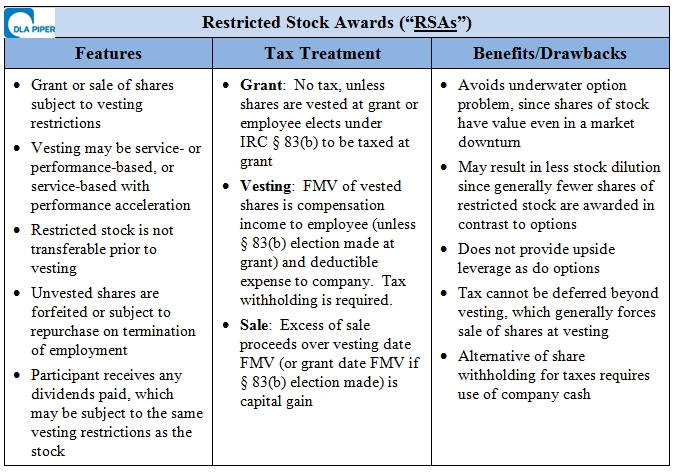

Employees receive a bonus in cash or equivalent number of shares based on how much the stock value increases over a set period of time - usually from the date of granting the right up until the right is. Stock Appreciation Rights. Stock appreciation rights give the employee the right to receive compensation in cash or stock or a combination of these at some future date based on the difference between the market price of the stock at the date of exercise over a pre-established price.

A stock appreciation right is a form of incentive or deferred compensation that ties part of your income to the performance of your companys stock. Employers almost always pay this type of bonus in cash. All rights of an employee in a stock appreciation right to the extent that it has not been exercised shall terminate upon the death of the Employee except as herein after provided or the termination of his employment for any reason other than retirement because of age or total and permanent disability and in case of such retirement three 3 years from the date thereof or upon expiration of the stock.

The Binary Option Stock Options Vs Stock Appreciation Rights Robot generates trading signals and automatically executes trades direct to your linked broker account. They are granted as part of a compensation package and upon receipt theyre issued with key dates and figures of which you should be aware. In the last step after the block period the employee exercises the option and settles the same in either cash or equity form.

While a company could issue restricted capital interests options to buy interests or interest appreciation rights very similar to restricted stock stock options and stock appreciation rights. A welldefined point of. Employees are usually required to pay the exercise price before they can get the shares.

A Stock Appreciation Right SAR refers to the right to be paid compensation equivalent to an increase in the companys common stock price over a base or the value of appreciation of the equity shares currently being traded on the public market. The entitlement in each case is. Stock appreciation rights look and act very similar to non-qualified stock options.

No taxation in the hands of the participants on granting or vesting. No obligation of an upfront payment by the employee. The grant date is the date the stock appreciation right is given to you.

Come under D11112 eur-lexeuropaeu. The performance hurdle is relevant with respect only to payment entitlement and not to the calculation of the amount of the payment. It gives you the right to the monetary equivalent of the appreciation in the value of a specified number of shares over a specified period of time.

Stock appreciation rights are a type of incentive plan based on your stocks value.

Equity Compensation Alphabet Soup Iso Nso Rsa Rsu And More The Venture Alley

/close-up-of-stock-market-data-on-digital-display-1058454392-78dbb4eff1ff4d0a98f23ebd49cc78f7.jpg)

Stock Appreciation Rights Sars Definition

Esops And Sars A Comparative Guide Tax India

Share Based Employee Benefits Regulatory Aspects

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-f215806b843b4874ae6e1a0481724d7d.jpg)

Employee Stock Option Eso Definition

Stock Appreciation Right Sar Overview How It Works Example

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-04-9b5dfea250a14cd9902b1d3406e185b2.jpg)

Employee Stock Option Eso Definition

Posting Komentar untuk "E Stock Appreciation Rights"