Appreciation And Depreciation Worksheet With Answers

10272016 72153 PM. Once the book value equals the original salvage value it is considered a fully.

How To Go From Md To Real Estate Magnate Cash Flow Wealthy Doc Real Student Encouragement Wealth Building

This workbook is designed to calculate depreciation expense for one fiscal year.

Appreciation and depreciation worksheet with answers. Effects of Exchange Rate Changes. Items that depreciate in value are. Using the straight line depreciation method the tractor would depreciate by 5000 per year for a total accumulated depreciation of 20000.

Currency Appreciation Depreciation. Displaying all worksheets related to - Depreciation Straight Line Method. Therefore its value is said to depreciate.

Appreciation is usually expressed as a percentage. D Explain how charging depreciation is an example of the application of the principle of. The depreciation is calculated on the net cost price and the same amount is written off each year.

The calculations round off to the nearest month to calculate the number of months each asset is in service during the year. Depreciation worksheet d The help pages accessed for this worksheet include. Tabulation of the Rows and Columns.

Depreciation refers to when the value of something goes down over time. Period of 7 vears. Appreciation and Depreciation Singlenotebook 7 February 21 2018 Apr 22-1358.

Tests the students on three depreciation methods ie. Calculate the weight of grapes that will be produced in 5 years time. Assets will lose value over time as they are being used and as they age.

Each asset has its own worksheet and as assets are entered and saved an entry is made in the Index. You can create a depreciation worksheet in the words so that you can make in some edits in the sheet later on with the change in the time and cost. The value of a car is usually decreases in value with time.

Go to the Depreciation worksheet. Another worksheet on depreciation. Last updated November 27 2020.

A loss or decrease in value over time. A calculator to quickly and easily determine the appreciation or depreciation of an asset. If you can answer every question correctly it will be excellent preparation for your exams interviews and professional work.

47 Something went wrong please try again later. Answer to Solved 5. Pranjali needs to correct the errors on this worksheet before she can perform any depreciation calculations.

Working with appreciation and depreciation test questions 1 Calculate the interest earned on 420 when it is put in an account which pays an interest rate of 7 per year. Revision worksheet on calculations involving appreciation and depreciation. Jack and Trisha.

Microsoft Word - Appreciation and Depreciation worksheetdocx Created Date. Finding the appreciation or depreciation after so many days weeks or years. This is a good study resource but I am pretty sure that the answers for questions 1 and 2 are wrong.

Create the Worksheet in Words. How much would that fixed asset be worth in 5 years time. Add the rows and the columns that the table must contain in it and in the specific tables mention in the facts and.

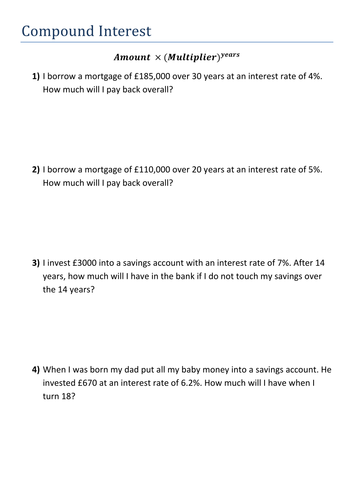

Compound Interest and Depreciation. The appreciation will offset the. Also a growing collecting of Maths Codebreaker worksheets for students of all abilities.

This is what is known as depreciation. 5 Steps to Create the Depreciation Worksheet Step 1. Depreciation Think about it.

A vinyard produced 250 kilograms of grapes in 2005. Go to the Depreciation worksheet. If you were to buy a new van for a business today that costs 16000.

Depreciation Worksheet DepMethod 000 000 100 DepMethod 000 000 100 Factors MACRSYears Methods Methods NoSwitch Fixed Assets Depreciation Worksheet Check Max Min Selection -Asset Description Cost Year of Purchase Salvage Value Useful Life Method Year Total Straight Line Method Sum-Of-Years Digits Method. If a country has a trade deficit and the local currency appreciates _____. Home - Firrhill High School.

The depreciation expense appears on a profit and loss statement while the book value and accumulated depreciation accounts appear on a balance sheet. Straight line diminishing balance and revaluation method. The index also offers entry to other dialogs that assist with the complexities of managing depreciating assets pooled or otherwise and projects.

Worksheets are Depreciation Depreciation questions Accounting test paper questions with answers on accounting Provision for depreciation and disposal of assets title 6 Interest and depreciation Fixed assets depreciation additions disposals Depreciation 2018 instructions for form 4562. A collection of engaging Maths resources for key skills at KS3 and KS4 revision. Creative Commons Sharealike Reviews.

If given the final amount after a increase or decrease you may be asked to find the original amount before the change. A large collection of Number Pyramids and Product and Sum worksheets that can be used to stretch and challenge all students. Worksheet with Product Rule Power Rule and Quotient Rule Questions with Video Solutions Video Solutions to Above Worksheet Follow-up Worksheet for you to try Chapter 72 Exponent Law Questions from Text Appreciation and Depreciation Powerpoint Half-Lives Worksheet Appreciation and Depreciation Questions Worksheet.

A gain or increase in value over time. If you find any questions difficult visit the depreciation chapter on our website to find out the necessary details about depreciation see the Financial Accounting section. Cars Machinery Technology eg.

Designed for mobile and desktop clients. Buildings Antiques Paintings Jewellery Works of Art. A business will need to.

Click on the printer icon below and print the worksheet. It is formlated using the straightline depreciation method. For the next 5 yea1S.

Finds the daily monthly yearly and total appreciation or depreciation rates based on starting and final values. Items that appreciate in value are. C Explain the reducing diminishing balance method of depreciation.

The Impact of Currency Appreciation Depreciation on Trade Deficits. It is estimated the vinyard will be able to Increase production at a rate of 3 pa. The same percentage is written off each year but it is calculated on the net book value of the asset.

Thanks to the SQA and authors. An increase in the value of a domestic currency will mainly affect _____.

Compound Interest And Depreciation Teaching Resources

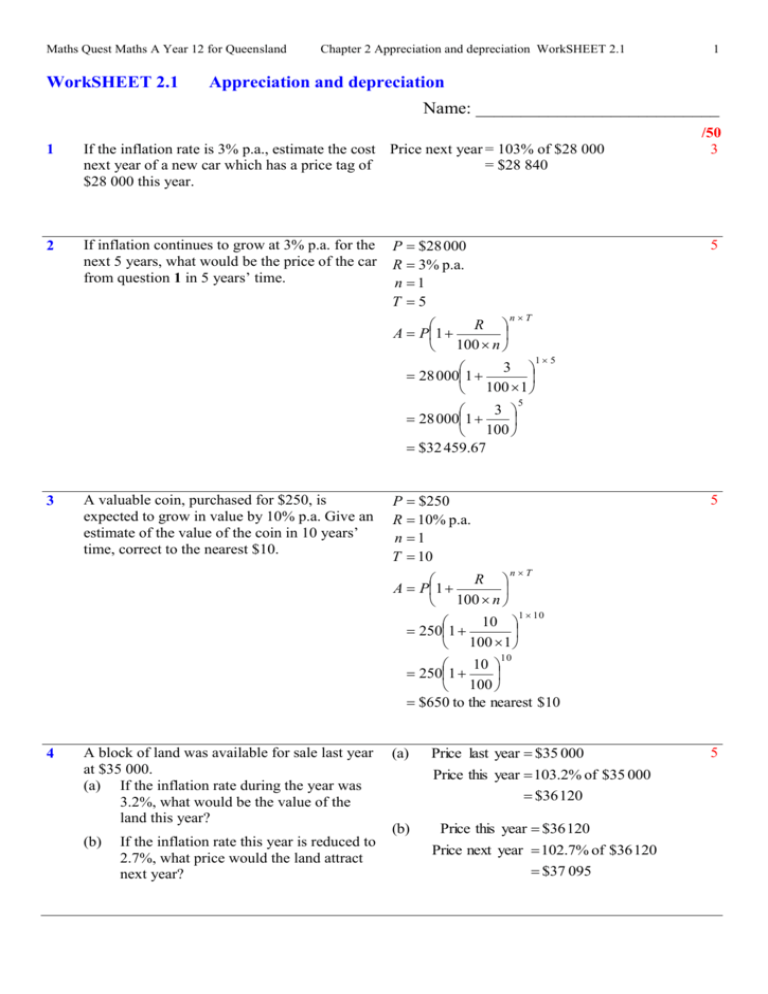

Worksheet 2 1 Appreciation And Depreciation

Quiz Worksheet Currency Appreciation Depreciation Study Com

Appreciation Vs Depreciation Kashoo

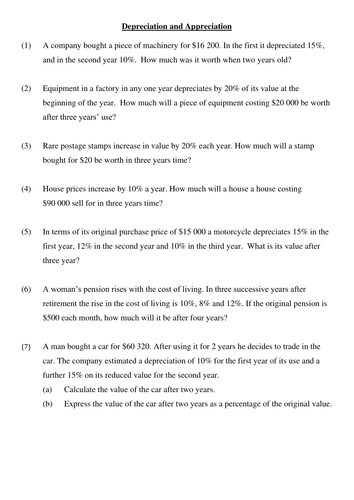

Depreciation And Appreciation Teaching Resources

Quiz Worksheet Currency Appreciation Inflation Study Com

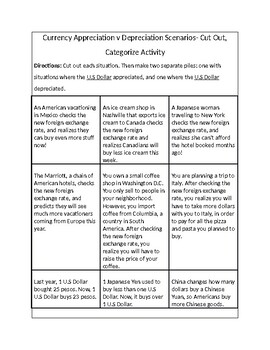

Currency Appreciation V Depreciation Scenarios Cut Out Categorize Activity

National 5 Mathematics Appreciation Depreciation Worksheet Powerpoint Teaching Resources

Currency Appreciation V Depreciation Scenarios Cut Out Categorize Activity

Quiz Worksheet Currency Appreciation Unemployment Study Com

Financial Maths Appreciation And Depreciation By Www Maths Grinds Ie

Dikonversi Pdf Currency Appreciation And Depreciation Depreciation

Posting Komentar untuk "Appreciation And Depreciation Worksheet With Answers"